Discovering Exactly How Investing Off Shore Works: A Comprehensive Overview

Investing offshore offers a complicated landscape of challenges and possibilities. Comprehending the numerous sorts of overseas accounts is important for any individual considering this path. The advantages, including improved personal privacy and possession defense, are significant. Nonetheless, lawful and tax effects necessitate cautious attention. As capitalists look for to maximize their profiles, the steps to develop a practical overseas financial investment strategy end up being crucial. What are the crucial elements that must browse to do well in this venture?

Comprehending Offshore Accounts and Their Kinds

What drives people and organizations to consider offshore accounts? The attraction of financial personal privacy, asset defense, and possible tax obligation benefits commonly attracts the interest of those seeking to manage their wealth more tactically. Offshore accounts, generally established in foreign jurisdictions, been available in various types. Individual accounts accommodate individual requirements, providing services like savings, financial investment, or retired life planning. Organization accounts, on the other hand, offer companies seeking to help with worldwide transactions, improve privacy, or maximize tax commitments. Depend on accounts supply an additional layer of protection, allowing individuals to guard their possessions for future recipients. Each type of offshore account offers unique attributes, commonly influenced by the regulatory atmosphere of the host nation. Comprehending these distinctions is necessary for people and businesses, as the option of account kind can especially influence their economic techniques and compliance with international regulations.

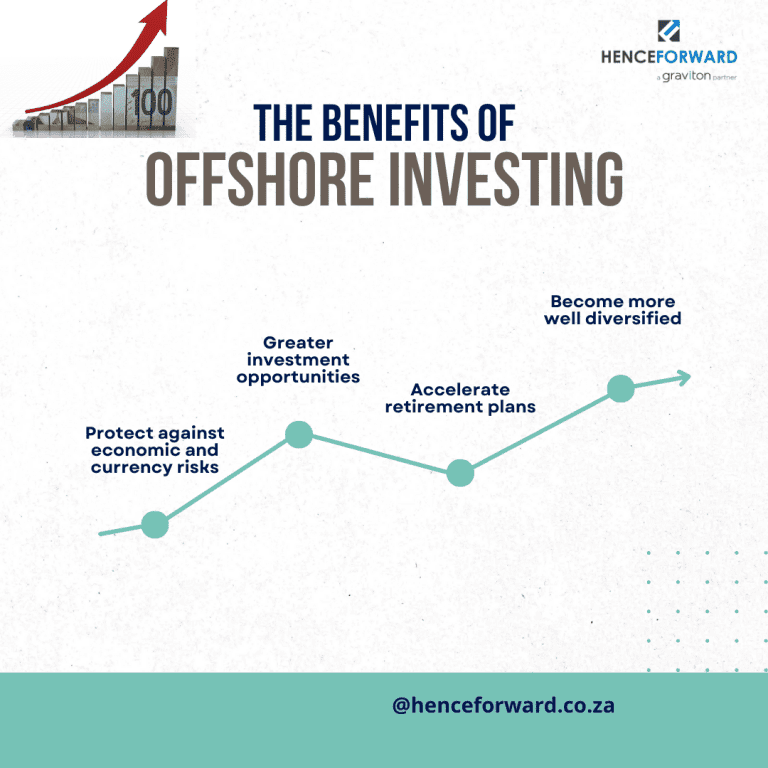

Benefits of Offshore Investing

While lots of capitalists look for opportunities to diversify their portfolios, offshore spending presents distinct benefits that can enhance monetary development and protection. One remarkable benefit is the potential for asset protection. Offshore accounts can safeguard investments from political instability or financial declines in the investor's home nation. In addition, offshore financial investments usually supply accessibility to worldwide markets, allowing financiers to use arising economies and fields that may not be readily available domestically.Another substantial advantage is tax effectiveness. Lots of offshore territories supply beneficial tax obligation routines, which can decrease tax obligation obligations and enhance total returns. Offshore investing can enhance privacy, as specific territories apply rigorous confidentiality laws.Lastly, offshore accounts can assist in wealth management approaches by supplying a larger range of financial investment options, consisting of different properties such as genuine estate and commodities. Collectively, these advantages make offshore spending an attractive choice for those looking to enhance their financial profiles.

Legal and Regulative Factors to consider

Guiding via the legal and regulatory landscape of offshore investing calls for cautious focus and understanding. Investing Off Shore. Financiers must navigate a complex web of legislations that differ considerably from one territory to another. Conformity with neighborhood regulations is vital; failure to do so can result in serious penalties, including penalties and jail time. Additionally, understanding the lawful frameworks regulating foreign investments is necessary for ensuring the protection of properties and preserving operational legitimacy.Key factors to consider include comprehending the regulative requirements for developing offshore entities, such as depends on or companies, and sticking to anti-money laundering (AML) and know-your-customer (KYC) guidelines. Capitalists must additionally know reporting commitments in their home nation, as many nations call for disclosure of offshore holdings. Engaging with lawyers experienced in offshore financial investment can offer vital guidance, aiding investors to mitigate threats and secure compliance with applicable legislations and laws while optimizing their financial investment potential

Tax Implications of Offshore Investments

Understanding the lawful and regulatory considerations of offshore investing naturally causes an examination of the tax ramifications connected with these financial investments. Offshore investments can supply significant tax obligation benefits, including reduced tax obligation prices and the potential for tax deferral. Nevertheless, investors need to navigate complicated tax guidelines in their home countries, as many territories need taxpayers to report international revenue and assets.For united state citizens, the Foreign Account Tax Compliance Act (FATCA) mandates the reporting of overseas accounts, while other nations have similar needs. Failing to conform can result in serious charges. Additionally, particular overseas funds may undergo one-of-a-kind tax therapies, such as Passive Foreign Investment Business (PFIC) policies, making complex financial investment strategies.Investors must think about consulting tax professionals to comprehend implications specific to their Recommended Reading situations and guarantee compliance with both domestic and international tax regulations, inevitably maximizing the benefits of their offshore investments while minimizing dangers.

Actions to Get Started With Offshore Spending

Several financiers seeking to expand their portfolios turn to overseas investing as a practical choice. To start, one must carry out detailed research study on potential offshore territories, considering variables such as governing setting, taxes, and investment opportunities. Investing Off Shore. After picking an appropriate location, capitalists should develop an offshore account, which normally calls for documents verifying identity and source of funds.Next, investors frequently involve with an overseas financial investment or a financial advisor company acquainted with regional laws and market characteristics. This collaboration can aid in crafting a customized investment method that straightens with specific goals and take the chance of tolerance.Once the approach is in place, financiers can continue to choose particular assets or funds for financial investment, guaranteeing they examine performance and takes the chance of regularly. Maintaining compliance with both regional and home country regulations is crucial for effective offshore investing, requiring ongoing diligence and possibly periodic assessments with lawful experts.

Regularly Asked Concerns

Exactly how Do I Choose the Right Offshore Jurisdiction?

Selecting the ideal overseas jurisdiction includes assessing factors such as regulative environment, tax advantages, political security, and convenience of doing business. Investigating each option completely assures educated decisions that align with individual investment goals and take the chance of resistance.

What Kinds Of Properties Can I Hold Offshore?

Are There Risks Related To Offshore Investing?

The risks related to offshore investing include legal intricacies, regulatory changes, currency variations, and possible political instability. Investors have to thoroughly examine these variables to reduce dangers and warranty conformity with global laws and policies.

Exactly How Can I Access My Offshore Funds?

To gain access to overseas funds, people usually need to contact their banks, provide required recognition and paperwork, and adhere to recognized procedures for fund transfers, ensuring compliance with both neighborhood and global laws controling offshore financial investments.

What Are Common Mistaken Beliefs Regarding Offshore Accounts?

Typical misconceptions about overseas accounts include beliefs that they are solely for tax obligation evasion, absence of guideline, try these out or only accessible to the affluent. In truth, they can be legitimate economic tools for varied individuals. Additionally, overseas financial investments commonly provide accessibility to global markets, permitting financiers to touch right into arising economic climates and sectors that may not be readily available domestically.Another significant benefit is tax performance. Overseas investing can improve personal privacy, as particular territories implement rigorous discretion laws.Lastly, overseas accounts can facilitate wide range administration methods by offering a wider array of financial investment alternatives, consisting of different properties such as actual estate and assets. Recognizing the regulative and lawful factors to consider of offshore investing normally leads to an evaluation of the tax implications connected with these investments. Offshore financial investments can provide considerable tax advantages, consisting of lowered tax obligation prices and the capacity for tax obligation deferral. After picking an appropriate my review here place, investors should establish an overseas account, which normally needs paperwork proving identification and resource of funds.Next, investors frequently engage with a financial advisor or an offshore investment company familiar with regional legislations and market dynamics.